Option Calendar Spread

Option Calendar Spread – With Alphabet stock trading at $170, setting up a calendar spread at $175 gives the trade a neutral to slightly bullish outlook. Selling the May 31 call option with a strike price of $175 and . The long put calendar spread is a strategy designed to profit from a near-total coma in the underlying shares. Employing two different put options spread across two calendar months — with a .

Option Calendar Spread

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

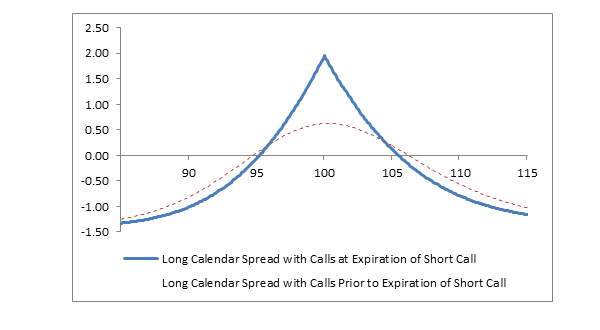

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

How to Trade Options Calendar Spreads: (Visuals and Examples)

Source : www.projectfinance.com

Option Calendar Spreads CME Group

Source : www.cmegroup.com

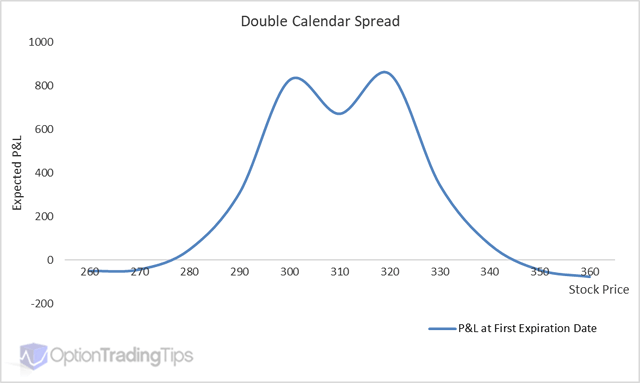

Double Calendar Option Spread

Source : www.optiontradingtips.com

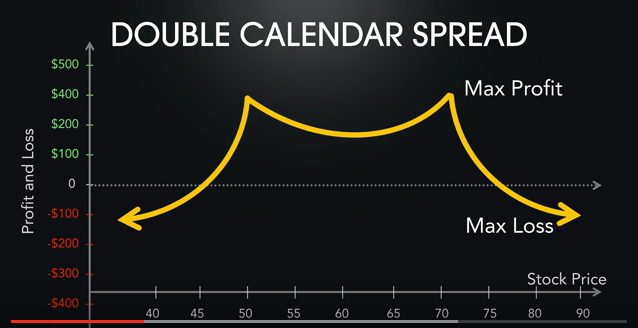

The Double Calendar Spread

Source : www.options-trading-mastery.com

options Understanding the visual representation of a Calendar

Source : money.stackexchange.com

Long Calendar Spreads Unofficed

Source : unofficed.com

Option expiry trading strategy (Double calendar spread) | no

Source : www.youtube.com

Option Calendar Spread Calendar Spreads in Futures and Options Trading Explained: Multiplied by 100 shares per contract, you’ve spent $52 to enter the calendar spread. In the best-case scenario, Stock XYZ will be trading squarely at the strike price of your call options when . Remember, that Calendar spread can be done in options and also in futures. In the Indian context, both are popular but we will focus on calendar spread on Nifty futures for simplicity. The logic .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)